Here in the U.S., today marks "Cyber Monday": an unofficial holiday observed on the Monday after Thanksgiving that celebrates and encourages online shopping with special deals and sales.

Online holiday shopping, however, is far from limited to just one day of the year. In fact, it began early, with online spending seeing record amounts on this year's Thanksgiving Day.

But when it comes to the battle of online retailers, who's at the top? As it turns out, there's been a shakeup in the ecommerce leaderboard.

Here's how the ecommerce wars are shaping up, and who's taking the lead in this year's holiday season.

Walmart Overtakes Apple

Most people might not think of Apple as an online retailer. It has brick-and-mortar locations that offer its branded, on-site "Genius" consultants that help customers pick products and troubleshoot technical issues.

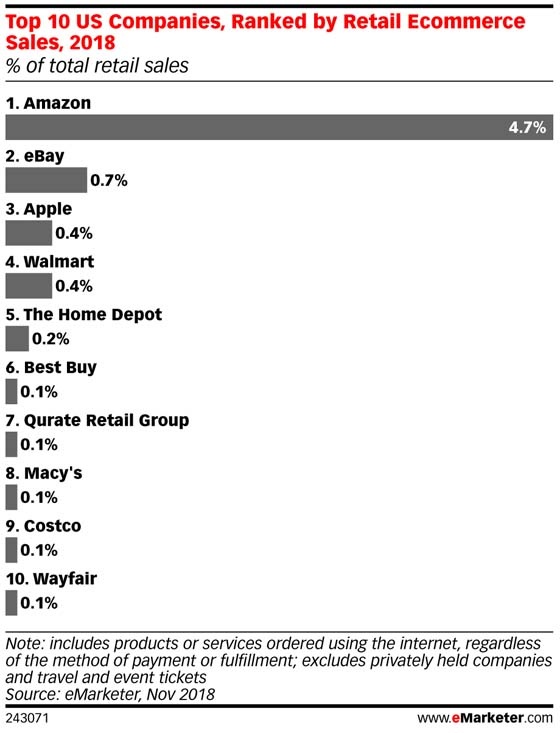

But enough people purchase Apple products from the company's website, it seems, to rank it as the #3 online retailer in the U.S., according to eMarketer.

.jpg?t=1543269737239&width=560&name=570af53a-62ea-4381-8e38-79d69d5773a1%20(1).jpg)

Source: eMarketer

That's changed in 2018, though. This year, eMarketer has projected that Walmart will overtake Apple's #3 position on the top five list of online retailers, bumping the latter to #4.

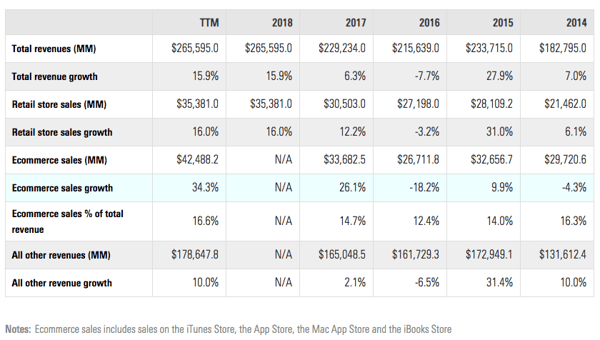

There are a few reasons for this projection, but according to eMarketer's report, many of them point to disparities in growth. Whereas Walmart has been identified as having one of the fastest-growing business in the ecommerce landscape, Apple's growth has slowed -- dropping 18% from last year's 26.1%.

Source: eMarketer

Walmart, meanwhile, is eyeing 2018 ecommerce sales growth of 39.4% -- more than 2X as much as Apple's.

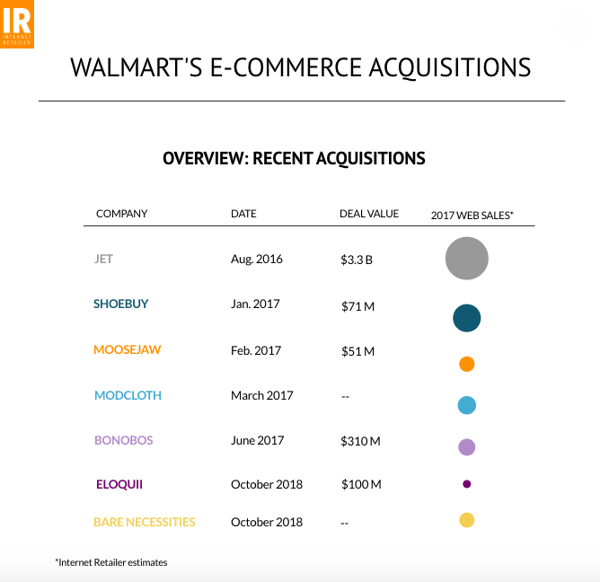

Again, a few factors could be contributing to this disparity, ranging from missed expectations on demand for Apple's latest iPhones (to the point where the company cut production on all three models announced in September) to Walmart's online business diversification by way of acquisitions.

Source: Digital Commerce 360

eBay, meanwhile -- which has maintained its #2 spot on the list in 2018 -- is seeing its share of ecommerce sales slipping, dropping .4% from 2017.

But all three -- Apple, eBay, and Walmart -- have quite a way to go in the road to #1.

Amazon Continues to Take the Lead

Amazon has not only maintained its #1 position on the list, as well as its lead lead over the other top four online retails on the list -- but has actually increased its lead over others on the list.

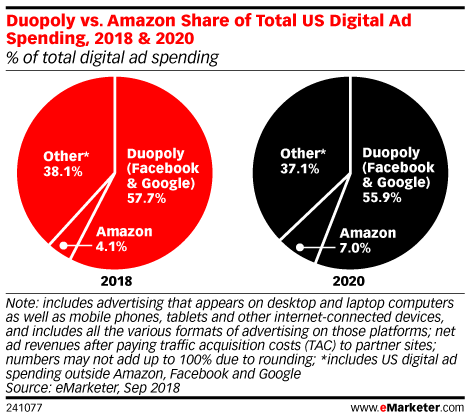

This growth possibly underscores Amazon's competitive edge in the area of digital ads, as well -- -- especially given that one of Amazon's advertising competitors, Facebook, experienced a glitch on its platform that made creating new campaigns a challenge for some marketers.

Before 2020, eMarketer also predicts that ads spend on the leading online retail site will increase by about 3%, slightly eating into the current "duopoly" held by Facebook and Google.

Source: eMarketer

But where there is more online buying behavior, there could be more motivation to spend on ads. Consider, for instance, that Amazon recently reached a deal with Apple to sell new iPhones and iPads on its site -- which carries the potential to increase Amazon's market share of ecommerce sales while continuing to chip away at Apple's.

And as Amazon's physical presence, too, continues to grow -- between its cashierless brick-and-mortar stores and two new slated HQ locations -- it raises the questions of what additional selling partnerships the ecommerce giant could form with other online retail leaders.

Have a look at this list of the top ten:

Source: eMarketer

Given Amazon's existing history of such deals -- as well as its acquisition portfolio -- it might not come as a huge surprise should Amazon acquire or strike similar agreements with other companies on this list. That would lead to further growth of Amazon's ecommerce sales market share and, in turn, perhaps encourage more ad spend.

What Marketers and SMBs Should Do Now

In any case, ecommerce is growing, presenting new opportunities for marketers and small-to-midsize businesses (SMBs) alike -- when approached with caution.

In its annual Holiday Predictions report, Adobe highlights a few key takeaways for navigating the holiday marketing (and shopping) landscape.

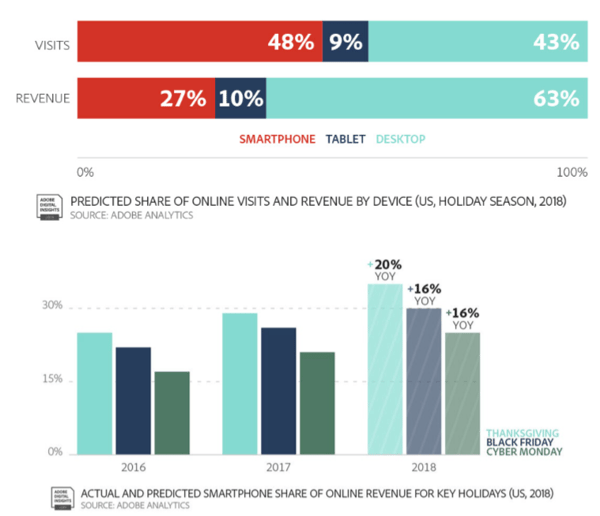

Be Mobile-Friendly

Over half of online transactions this season will take place on smartphone.

Source: Adobe

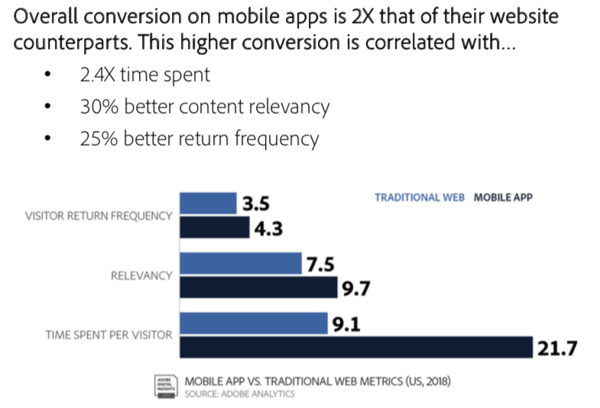

Get Appy

Also within the realm of mobile, start to think about ways your business could create and make use of an app -- as app users are twice as likely to convert into customers.

Source: Adobe

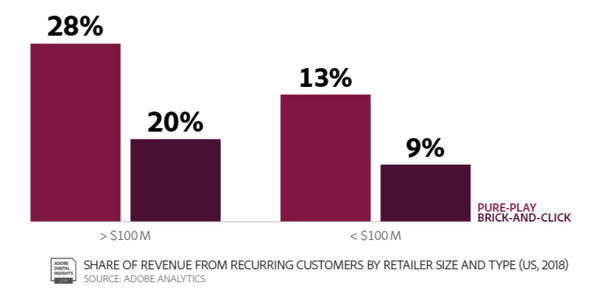

Lean Into New Customers

According to Adobe's report, businesses with $100 million or less in annual online revenue see more value from new customers -- with only a small portion of that revenue coming from recurring customers.

And Here's One From Us

Any time of year -- especially during the frenzied holiday season -- make it easy for people to reach you and, in turn, become customers. For example, advises HubSpot VP of Marketing Jon Dick, for those who prefer to use messaging to reach you, build a way for them to do that (through apps, for example, like Messenger or WhatsApp).

"More B2B buyers are communicating with their sales reps through messaging, because more B2B buyers connect with their friends through SMS and messaging," says Dick. "If you're an SMB B2B company, you need to be implementing a buying process that is easy and is aligned with how people like to communicate, shop and buy today."

Good luck out there. And, of course -- happy holidays.

No comments:

Post a Comment