"Business is personal -- it's the most personal thing in the world."

These are famous words by Michael Scott from the TV show, The Office. And although this quote conflicts with the universal belief that business isn't personal, Michael's point of view is perfect when learning about a business's fixed costs -- or those costs that don't change as a company grows or shrinks.

To identify and calculate your business's fixed costs, let's start by looking at the ones you're already paying in your personal life. Then, we'll explain how a business manages its own fixed costs and review some common fixed cost examples.

What Is a Fixed Cost?

Fixed costs are those costs to a business that stay the same regardless of how the business is performing. These costs are known as fixed costs to distinguish them from variable costs, which do change as the company sells more or less of its product.

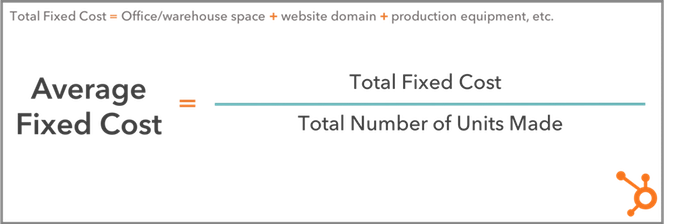

Fixed Cost Formula

- Identify your building rent, website cost, and similar monthly bills.

- Consider future repeat expenses you'll incur from equipment depreciation.

- Isolate all of these fixed costs to the business.

- Add up each of these costs for a total fixed cost (TFC).

- Identify the number of product units created in one month.

- Divide your TFC by the number of units created per month for an average fixed cost (AFC).

Consider your personal routine. As a single adult, your expenses would normally include a monthly rent or mortgage, utility bill, car payment, healthcare, commuting costs, and groceries. If you have children, this can increase variable costs like groceries, gas expenses, and healthcare.

While your variable costs increase after starting a family, your mortgage payment, utility bill, commuting costs, and car payment don't change for as long as you're in the same home and car. These expenses are your fixed costs because you pay the same amount no matter what changes you make to your personal routine.

In keeping with this concept, let's say a startup ecommerce business pays for warehouse space to manage its inventory, and 10 customer service employees to manage order inquiries. It suddenly signs a customer for a recurring order that requires another five paid customer service reps. While the startup's payroll expenses go up, the fixed cost of a warehouse stays the same.

Average Fixed Cost

Keep in mind you have to keep track of your business's fixed costs differently than you would your own. This is where average fixed cost comes into play.

Average fixed costs are the total fixed costs paid by a company, divided by the number of units of product the company is currently making. This tells you your fixed cost per unit, giving you a sense of how much the business is guaranteed to pay each time it produces a unit of your product -- before factoring in the variable costs to actually produce it.

Let's revisit the ecommerce startup example from earlier. Assume this business pays $5,000 per month for the warehouse space needed to manage its inventory, and leases two forklifts for $800 a month each. And last month, they developed 50 units of product.

The warehouse and forklift costs remain unchanged regardless of how many products they sell, giving them a total fixed cost (TFC) of $5,000 + ($800 x 2), or $6,600. By dividing its TFC by 50 -- the number of units the business produced last month -- the company can see its average fixed cost per unit of product. This would be $6,600 ÷ 50, or $132 per unit.

Fixed Cost Examples

So far, we've identified a handful of fixed cost examples since considering the costs we already pay as individuals. A home mortgage is to a lease on warehouse space, as a car payment is to a lease on a forklift.

But there are a number of fixed costs your business might incur that you rarely pay in your personal life. In fact, some variable costs to individuals are fixed costs to businesses. Here's a master list of fixed costs for any developing company to keep in mind:

- Lease on office space: As long as your business operates in the same building, your rent cost doesn't change.

- Utility bills: Your heating or cooling bill might fluctuate as seasons change, but it is generally not affected by business operations.

- Website hosting costs: When you register your website domain, you pay a small monthly cost that remains static despite the business you perform on that website.

- Ecommerce hosting platforms: Ecommerce platforms integrate with your website so you can conduct transactions with customers. They typically charge a low fixed cost per month.

- Lease on warehouse space: Warehouses are paid for the same way you'd pay rent on your office space. They do not change in price as you store more or fewer products inside, but can have storage and capacity limits.

- Manufacturing equipment: The equipment you need to produce your product is yours once you buy it, but it will depreciate over its useful lifetime. Depreciation can become a fixed cost if you know when you'll have to replace your equipment each year.

- Lease on trucks for shipment: Truck leases work the same way as a car payment, and will not charge differently depending on how many shipments you make.

- Small business loans: If you're financing a new business with a bank loan, your loan payments won't change with your business's performance. They are fixed for as long as you have a balance to pay on that loan.

- Property tax: Your office space's building manager might charge you property tax, a fixed cost for as long as your business is on the property.

- Health insurance: Health insurance costs might be a variable cost to an individual if they add or remove dependents from their policy, but to a business, the recurring costs to an insurer are fixed.

Calculating your fixed costs isn't always the most fun part of growing your business. But knowing what they are, and when you'll pay each one, gives you the peace of mind you need to serve and delight your customers.

No comments:

Post a Comment