Did you know it costs a business about 5-10X more to acquire a new customer than it does to sell to an existing one? Not only that, but on average, current customers spend 67% more than new customers.

In light of statistics like these, businesses must think about what they are doing to keep their customers coming back to their business. And if you’re like 65% of marketers, your company has implemented a loyalty program.

But is your loyalty program working?

According to the 2015 Colloquy Customer Loyalty Census, American households hold memberships in an average of 29 loyalty programs, but are active (meaning earn or redeem at least one per year) in only 12 of them. Companies lose money on time and effort, and customers get no more value from the businesses to which they are "loyal."

So how do you keep your business out of that one-third segment? How do you convey enough additional value in your programs to keep your customers coming back?

It’s time for marketers to look beyond convoluted rewards systems and offer actual value to customers using their loyalty program. To get you started, here are some ideas for customer loyalty programs that might work for your business.

7 Customer Loyalty Program Ideas for Your Business

1) Use a simple point system.

This is the most common loyalty program methodology. Frequent customers earn points, which translate into some type of reward. Whether it’s a discount, a freebie, or special customer treatment, customers work toward a certain amount of points to redeem their reward.

Where many companies falter in this method, however, is making the relationship between points and tangible rewards complex and confusing.

"Fourteen points equals one dollar, and twenty dollars earns 50% off your next purchase in April!"

... that’s not rewarding, that’s a headache.

If you opt for a points-based loyalty program, keep the conversions simple and intuitive.

Although a points system is perhaps the most common form of loyalty programs, it isn't necessarily applicable to every business type. It works best for businesses that encourage frequent, short-term purchases, like Boloco.

Case Study: Boloco's Boloco Card

Boloco, an American restaurant chain known for its burritos, is an example of a company who does the points-based loyalty program well. Customers swipe their stylish Boloco Card at every purchase, and the card tracks the amount of money spent. Every $50 spent earns the customer a free item. It doesn't matter if that free item is a super jumbo burrito or an extra small smoothie: It's free once the customer records $50 on their card. Boloco speaks the language of its audience by measuring points in dollars, and rewards in food and drink items.

Source: Boloco

2) Use a tier system to reward initial loyalty and encourage more purchases.

Finding a balance between attainable and desirable rewards is a challenge for most companies designing loyalty programs. One way to combat this is to implement a tiered system which rewards initial loyalty and encourages more purchases.

Present small rewards as a base offering for being a part of the program, and then encourage repeat customers by increasing the value of the rewards as the customer moves up the loyalty ladder. This helps solve the problem of members forgetting about their points and never redeeming them because the time between purchase and gratification is too long.

The biggest difference between the points system and the tiered system is that customers extract short-term versus long-term value from the loyalty program. You may find tiered programs work better for high commitment, higher price-point businesses like airlines, hospitality businesses, or insurance companies.

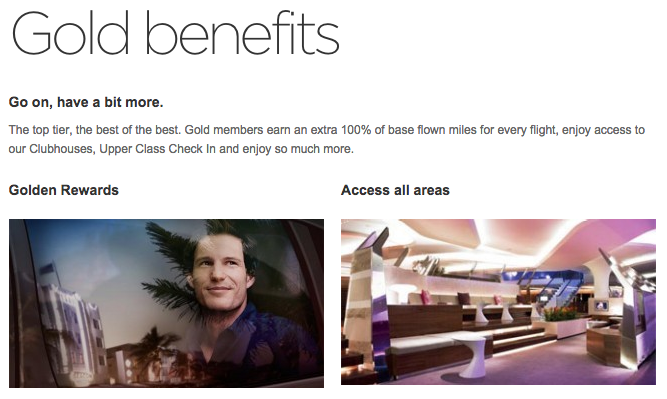

Case Study: Virgin Atlantic Flying Club

In addition to earning miles, Virgin Atlantics' Flying Club allows members to earn tier points. The club inducts members at the Club Red tier, then bumps them up to Club Silver and then Club Gold.

- Club Red members earn miles on flights and get discounts on rental cars, airport parking, hotels, and holiday flights.

- Club Silver members earn 50% more points on flights and have access to expedited check-in and priority stand-by seating.

- Club Gold members get double miles, priority boarding, and access to exclusive clubhouses where they can grab a drink or get a massage before their flight.

Seem complicated? They created a comprehensive benefits table so customers can easily understand the extra benefits they'll receive as they move from Red to Silver to Gold. The key is to offer benefits in the early stages to hook the customer into coming back. Once they do, they’ll realize that "gold" status isn’t unattainable, and offers really cool benefits.

Source: Virgin Atlantic

3) Charge an upfront fee for VIP benefits.

Loyalty programs are meant to break down barriers between customers and your business ... so are we seriously telling you to charge them a fee? In some circumstances, a one-time (or annual) fee that lets customers bypass common purchase barriers is actually quite beneficial for both business and customer. By identifying the factors that may cause customers to leave, you can customize a fee-based loyalty program to address those specific obstacles.

According to a 2015 study of 500 leading global brands, cart abandonment rates reached 75.6% across retail, travel, and fashion. This abandonment is often caused by "sticker shock" after tax and shipping prices have been applied. Below, we'll take a look at Amazon, the ecommerce giant that's found a way to combat this issue using a loyalty program with an upfront fee.

This system is most applicable to businesses that thrive on frequent, repeat purchases. For an upfront fee, your customers are relieved of inconveniences that could impede future purchases. Amazon's mastered this for ecommerce, but this model also has potential to work for B2B businesses that deliver products to businesses on a regular basis.

Case Study: Amazon Prime

For $99 a year, Amazon Prime users get free, two-day shipping on millions of products with no minimum purchase, among other benefits.

Why is this a great example? Because it provides enough value to frequent shoppers for them to feel like it's really benefitting them. Actually, analysts estimate Amazon loses $1-2 billion per year on Prime. But the company makes up for it in increased transaction frequency: According to a 2015 report from Consumer Intelligence Research Partners, Prime members spend an average of $1,500 per year on Amazon.com, compared with $625 per year spent by Amazon customers who aren't Prime members.

Source: Amazon Prime

4) Structure non-monetary programs around your customers' values.

Truly understanding your customer means understanding their values and sense of worth. Depending on your industry, your customers may find more value in non-monetary or discounted rewards. While any company can offer promotional coupons and discount codes if they want to, businesses that can provide value to the customer in ways other than dollars and cents have a unique opportunity to connect with their audience.

Case Study: Patagonia's Common Threads Initiative

Patagonia, an eco-friendly outdoor apparel company, realized that its customer needed more than just points and discounts from a loyalty program. In conjunction with eBay, it implemented the Common Threads Initiative in late 2011 to help customers resell their highly durable Patagonia clothing online via Patagonia's website.

The Common Threads program builds on Patagonia's brand of sustainability and creating a high-quality product. Plus, it matches perfectly with the company’s target audience by providing a value they know customers really care about.

Source: Patagonia

5) Partner with another company to provide all-inclusive offers.

Strategic partnerships for customer loyalty (also known as coalition programs) can be super effective for retaining customers and growing your company. Which company would a good fit for a partnership? Again, it boils down to fully understanding your customers' everyday lives and their purchase processes.

For example, if you’re a dog food company, you might partner with a veterinary office or pet grooming facility to offer co-branded deals that are mutually beneficial for your company and your customer. When you provide your customers with value that's relevant to them but goes beyond what your company alone can offer them, you're showing them you understand and care about their needs. Plus, it'll help you grow your network to reach your partners' customers, too.

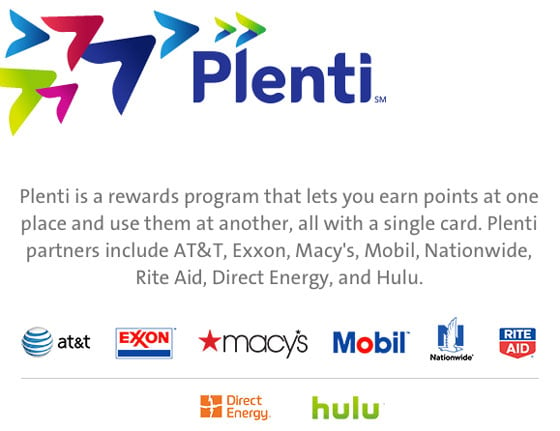

Case Study: American Express Plenti Program

American Express has a huge partner base with companies across the country. The company's Plenti program, launched in May 2015, lets consumers pool their rewards from various retailers like Macy's, AT&T, Rite Aid, Enterprise Rent-A-Car, Hulu, and more. Plenti members earn points for shopping at these stores and redeem points at these stores by linking their existing store loyalty card to their Plenti account. For example, customers can use Plenti points they've earned from something like renting a car from Enterprise in order to pay their AT&T phone bill.

Flexibility is the biggest appeal here for customers, since points can be earned and redeemed at a variety of retailers. According to Fortune Magazine, "For the companies, even ones like Macy's that already have huge loyalty programs, Plenti is a way to tap into the broader customer base of its partners, save on program costs, and lift sales by offering a more appealing program to customers."

Source: Interbrand

6) Make a game out of it.

Who doesn’t love a good game? Turn your loyalty program into a game to encourage repeat customers and -- depending on the type of game you choose -- help solidify your brand's image.

With any contest or sweepstakes, though, you run the risk of having customers feel like your company is jerking them around to win business. To mitigate this risk, it's important to make customers feel like you’re not duping them out of rewards. The odds should be no lower than 25%, and the purchase requirements to play should be attainable. Also, be sure your company's legal department is fully informed and on-board before you make your contest public.

When executed properly, this type of program could work for almost any type of company -- even an off-the-beaten-path B2B company. If your audience enjoys having a little fun and purchases frequently, this type of program can make the buying process both fun and engaging.

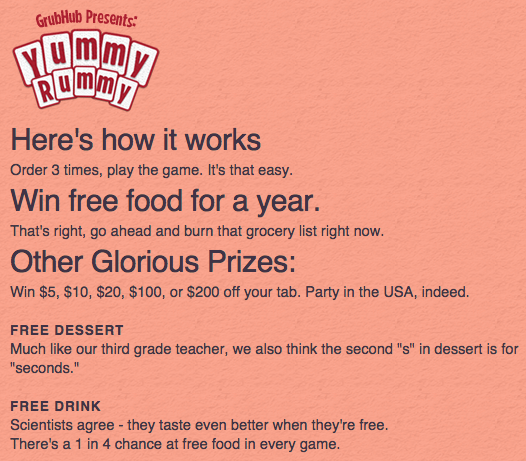

Case Study: GrubHub's Yummy Rummy Sweepstakes

GrubHub, an online food ordering and delivery website, has run its successful Yummy Rummy sweepstakes since 2011. Once customers place three unique orders through GrubHub, regardless of price, they get to play a game for a chance of winning free stuff. Players choose one of four cards and have a 25% chance of winning a free dessert, drink, GrubHub credit, or other cool stuff.

Casey Winters, who was part of the GrubHub team that launched the sweepstakes in 2011, advises in a LinkedIn post, "You should strive to think of your program as constantly evolving to stay interesting to your users. This will make your program stay effective for longer as well as give you the flexibility to tweak elements to make it more interesting to you as the business. I have seen many companies stuck with a program they no longer think is effective, but too afraid to shelve it because of potential user backlash."

Source: GrubHub

(Want to learn more about how to run a contest on social media? Read this blog post.)

7) Scratch the "program" completely.

Considering how many marketers offer loyalty programs, one innovative idea is to nix the idea of employing a program altogether. Instead, build loyalty by providing first-time users with awesome benefits, hooking them in, and offering those benefits with every purchase.

This minimalist approach works best for companies that sell unique products or services. That doesn't necessarily mean that you offer the lowest price, or the best quality, or the most convenience; instead, I’m talking about redefining a category. If your company is pioneering a new product or service, a loyalty program may not be necessary. Customers will be loyal because there are few other options as spectacular as you, and you've communicated that value from your first interaction.

For example, one of the most innovative companies on the planet implements this strategy: Apple.

Case Study: Apple

Even the most loyal Apple customers don’t get special rewards or discounts ... because it doesn't offer them to anybody. Apple "enchants" customers by delighting them with a product or service the very first time.

"The loyalty is voluntary and long-lasting," explains Apple evangelist Guy Kawasaki.

Apple has plenty of supporters, both online and offline, ready and willing to rave about its product. For them, loyalty happens organically.

How to Measure the Effectiveness of Your Loyalty Program

As with any initiative you implement, there needs to be a way to measure your marketing success. Customer loyalty programs should increase customer happiness and retention, and there are ways to measure these things (other than in rainbows and sunshine).

Different companies and programs call for different analytics, but here are a few of the most common metrics companies watch when rolling out loyalty programs.

Customer Retention Rate

This metric is an indication of how long customers stay with you. With a successful loyalty program, this number should increase over time as the number of loyalty program members grows. Run an A/B test against program members and non-program customers to determine the overall effectiveness of the loyalty initiative. According to Fred Reichheld, author of the Loyalty Effect, a 5% increase in customer retention can lead to a 25-100% increase in profit for your company.

Negative Churn

Churn is the rate at which customers leave your company. Negative churn, therefore, is a measurement of customers who do the opposite: either they upgrade, or they purchase additional services. These help to offset the natural churn that goes on in most businesses. Depending on the nature of your business and loyalty program, especially if you opt for a tiered loyalty program, this is an important metric to track.

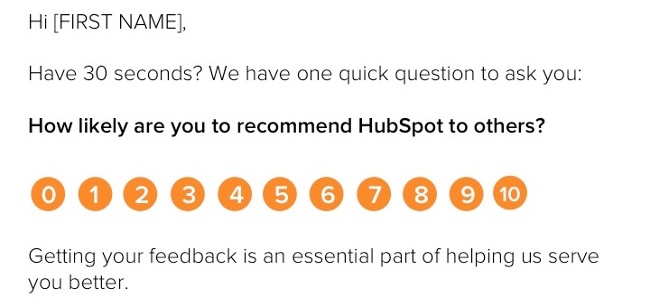

Net Promoter Score

NPS is a customer satisfaction metric that measures, on a scale of 1-10, the degree to which people would recommend your company to others.

NPS is calculated by subtracting the percentage of detractors (customers who would not recommend your product) from percentage of promoters (customers who would recommend you).

The fewer detractors, the better. Improving your net promoter score is one way to establish benchmarks, measure customer loyalty over time, and calculate the effects of your loyalty program. A great NPS score is over 70%, and your loyalty program can help get you there. (Read this blog post to learn how to use NPS surveys for more powerful marketing automation.)

Customer Effort Score

Customer Effort Score (CES) asks customers, "How much effort did you personally have to put forth to solve a problem with the company?"

Some companies prefer this metric over NPS score because it measures actual experience rather than the emotional delight of the customer. A Harvard Business Review study found that 48% of customers who had negative experiences with a company told 10 or more people. In this way, customer service impacts both customer acquisition and customer retention. If your loyalty program addresses customer service issues, like expedited requests, personal contacts, or free shipping, this may be one way to measure its success.

Have you implemented a customer loyalty program? Share what tactics worked (and what didn't) in the comment section.

Editor's Note: This post was originally published in April 2012 and has been updated for freshness, accuracy, and comprehensiveness.

No comments:

Post a Comment